Someone explain the joke pwease

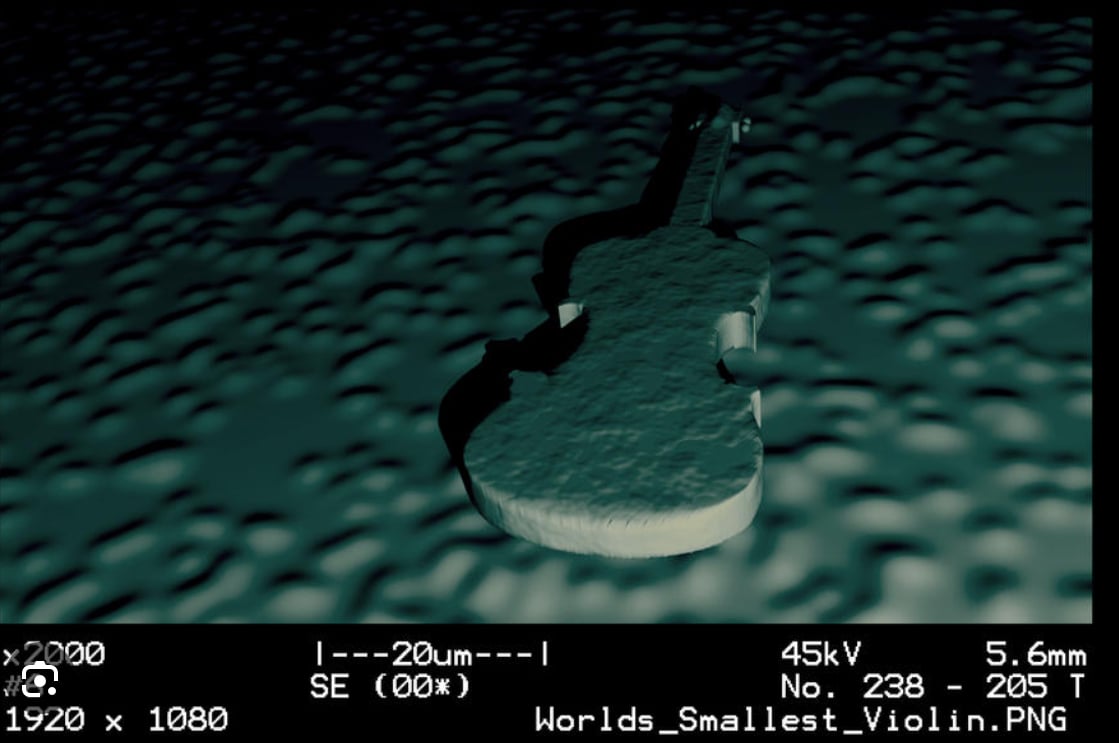

It’s an electron microscope of a violin built with individual atoms, as in “I will play the smallest violin in sympathy”

Did they actually do this? That still looks like it would be a hell of a lot of “individual atoms”

Do we have 3D atom printers? Is that a thing?

The scale shows it being 20 microns in width, so it’s still pretty big, relative to individual atoms. A micron is 10^-6 meters while the width of a hydrogen atom is about 10^-10 meters.

Makes sense that the scale is wrong, because somebody on DeviantArt made it in Blender/Photoshop

Makes sense, because I’ve never seen a SEM image like that… I thought it could’ve been an older model

Electron microscope of the worlds smallest violin. A way of mocking other’s problems by pretending to pretend to care.

It appears to be the worlds tiniest violin.

Further explanation of the joke

Still grossly overvalued.

Remember, this motherfucker bankrupted THREE casinos!

There is no limit to how badly he can fuck up a business.

Its true value is negative.

Sounds over-priced.

People are treating the “dump” part of a “Pump and Dump” like it’s some kind of a vindication, when suckers were already fully fleeced back at its $7B market cap peak.

It’s a Mastodon instance with a few thousand users trading at $16/share. Absolutely insane that anyone was buying this garbage at any price.

Absolutely insane that anyone was buying this garbage at any price.

That bribery money wasn’t going to launder itself.

Correct answer.

It matters because Trump becomes free to sell his shares on September 19 (a week from today). I, for one, am hoping that the price goes to $0 and it gets delisted by then!

He’s been able to borrow against them for some time. Someone is already holding the bag.

If he floods the market with shares, I wouldn’t be surprised if the price craters so hard it gets delisted.

Putting aside any feeling you may have for or against Trump, WTF does TMTG do? From what I can tell, it runs Truth Social and is planning to launch a streaming service.

I did some quick googling and Truth Social appears to be a mastodon instance with a non-default backend that is free to use with 600k active monthly users.

Facebook alone (not including other META products) has 2.9 billion active monthly users.

What’s so valuable about it? Sure, they are probably running ads. But why would someone advertise on Truth Social over Facebook? Is the conversion rate somehow better on truth social?

Money laundering.

From stock sales? Are they buying directly from the company? If not, I don’t think the company sees the money

Are they buying directly from the company?

Exactly, you guarantee you’ll buy shares of my company and I guarantee I’ll make decisions that benefit you.

Usually you buy from a market maker though

In this scenario the market maker and the briber are the same person.

Market makers only need to be willing to buy like 100 shares, that’d be pretty trivial for people with resources.

That’s less than $2k… Is the trade volume that low?

The idea was that the Saudis and Russians pump money into the stock to keep the price propped up until Donny can cash out, but that only works if you have enough cash to backfill the volume ratio as needed. It would work a lot better if they could have been quieter about it, but Trump basically makes billions as long as the price doesn’t actually go to zero since his shares are grants for using his “brand.”

It’s not so much money laundering as a completely legal path for foreign agents to buy favors from a possible US President.

It’s not valued based on any normal metric. It’s pure meme, speculation, cult and money laundering.

I doubt many investors even look at conversion rates.

Smells very similar to NFT

Non Flushable Turds?

But why would someone advertise on Truth Social over Facebook?

Because I could sell star spangled shit on a shingle to that lot for a premium.

What’s so valuable about it?

Nothing.

It’s a very unusual situation.

It’s basically a proxy for a bet on whether Trump will get a second term. That’s why it took a dump after the debate didn’t go well.

Supporters want to say they have some TMTG shares, and are happy to pay absurd prices for shares without reference to the actual value.

And outside the cult, it’s a bet that Truth Social would become a vector for bribing the president of the United States. If people are going to bribe Trump by pumping his share price, you can get a cut.

TMTG has a huge net operating loss. I think that the way the company is bribed is in investment funds.

However, I don’t think they are bribing him by pumping his share price. IIRC (take this with a hugeeeee grain of salt) the share price is determined by the last transaction price. If you place a market order, it’s the sell prices that would fulfill your order amount. On the other hand, a limit order is fulfilling your order at a set price. It would take consistent investment over time to create enough transactions to keep the stock price high.

Hence, I think TMTG is receiving large cash infusions and Trump is getting paid through bonuses or something similar. Cheaper and more direct

Oh come on just because we hate Trump doesn’t mean we should kid ourselves, there’s a lot of value to having access to 600k of the easiest to scam rubes on the planet.

Money + laundering of said money = most shit Dump has his name on

What’s so valuable about it?

It’s not. And a lot of people in the industry have pointed out that the valuation is pretty wildly decoupled from potential.

The most compelling argument I’ve heard is that it’s a lot of retail – small – investors who politically support Trump and have no idea what they’re doing buying into a complicated vehicle because Trump’s told them that he’s gonna make them rich. I remember some article a while back talking about the high proportion of retail investors.

kagis for an example

https://www.ft.com/content/5fdd8a48-ce51-4e3b-b450-49fce86f37d9

Small investors power Trump Media’s market valuation above $13bn

Heavy trading in company behind Truth Social fuels talk of a new cycle of ‘meme stock mania’

Donald Trump’s Truth Social platform is riding a wave of enthusiasm from small investors as a second day of gains took the lossmaking social media group’s valuation above $13bn.

Trump Media & Technology Group topped the leaderboard of most-discussed stocks in WallStreetBets, Reddit’s popular stock trading forum, for several hours on Wednesday.

“Hate Trump but I knew his minions wouldn’t be able to help themselves the moment the ticker changed. Would’ve doubled down if I had any additional funds,” said WallStreetBets user FlapjackInProtest, who claimed he had turned $500 into $6,000 by trading TMTG options. Others reporting winning bets drew praise. WallStreetBets user optimal_burrito replied to someone who posted that buying Trump Media was their first winning trade with the message: “You’re gonna start winning so much you’ll get sick of it #DJT.”

Honestly, I think that there’s some argument that the SEC should do something about people getting burned like this, though I’m sure that if they did, Trump would go into another one of his spiels on being oppressed.

Like, you may not like Trump supporters, but I remember reading some articles about people putting their life savings into this. I mean, it’s not gonna be pretty.

600k active accounts. Maybe half of them are real Americans.

Everybody be on guard. That uncle is about to hit you up for money after they put all of their non-Trump NFT money into DJT stock.

When is he allowed to cash in on his scam? That’s when the uncles will be leaving increasingly desperate phone messages that you will never check.

One day Jerboa will support animated gifs…

That sucks. I use Sync.

John Rekenthaler, vice president of research at Morningstar (MORN+0.470%), previously called DJT an “affinity stock” — one that trades on people’s feelings and perceptions of the former president, rather than its business performance. Rekenthaler warned that Trump Media stock would “go to zero or something close to it” if Trump were to lose the presidential election in November.

These new lows come just weeks before Trump will get the green light to offload his 114.75 million shares of Trump Media, or about 60% of the company’s outstanding stock. The Republican presidential hopeful stands to make upwards of $2 billion from the stock sale — although the value of those returns depends on the share price.

I think that it’s going to go to “zero or something close to it” once Trump starts bailing out. I don’t think that it’s going to need to reach the election and have Trump lose.

If he has to divulge his divestment it’s going to go to 0 before he can sell it all. If he doesn’t need to divulge it, it’s still going to go close to zero because the market for that stock won’t hold if 60% of it hits the market. If he’s been able to borrow against it, he’ll probably default and leave his lenders holding the bag.

the market for that stock won’t hold if 60% of it hits the market

There was also that legal fight that I haven’t been following earlier from some other cofounders trying to get the ability to exit earlier.

https://www.nytimes.com/2024/04/18/business/trump-media-ownership-fight.html

In their lawsuit, Mr. Moss and Mr. Litinsky claimed their right to 8 percent of Trump Media’s shares and the ability to sell them immediately. They alleged that Trump Media had unfairly barred their company, United Atlantic, from selling any shares for six months, just as the merger with Digital World was being completed. The timing of the action was punitive and “retaliatory,” Mr. Moss and Mr. Litinsky alleged.

If they haven’t managed to get the ability to exit before Trump, I’m assuming that those guys are going to be jumping ship at the first opportunity as well.

Oh, Donnie, NO! Margie, are you going to buy more stock to prop this up for your big wet boy?

Reminder that genius investor Marge was also holding the bag on $CRWD during the global outage that happened a while back. So. Much. Winning.

I wonder if that’s because most of its value is predicated on him being able to gain an unfair advantage due to his potential position in office.

If so, then this is probably a more accurate indicator of his chances in the election than any pollsters.

It’s exactly this reason.

Russian money will be coming in at any moment

What do you mean by that?

Line must go down

Ha, fucking ha.

lol